- Home

- /

- Supply Chain Finance

- /

- Charting the Course for the Future of Supply Chain Financing (SCF)

Charting the Course for the Future of Supply Chain Financing (SCF)

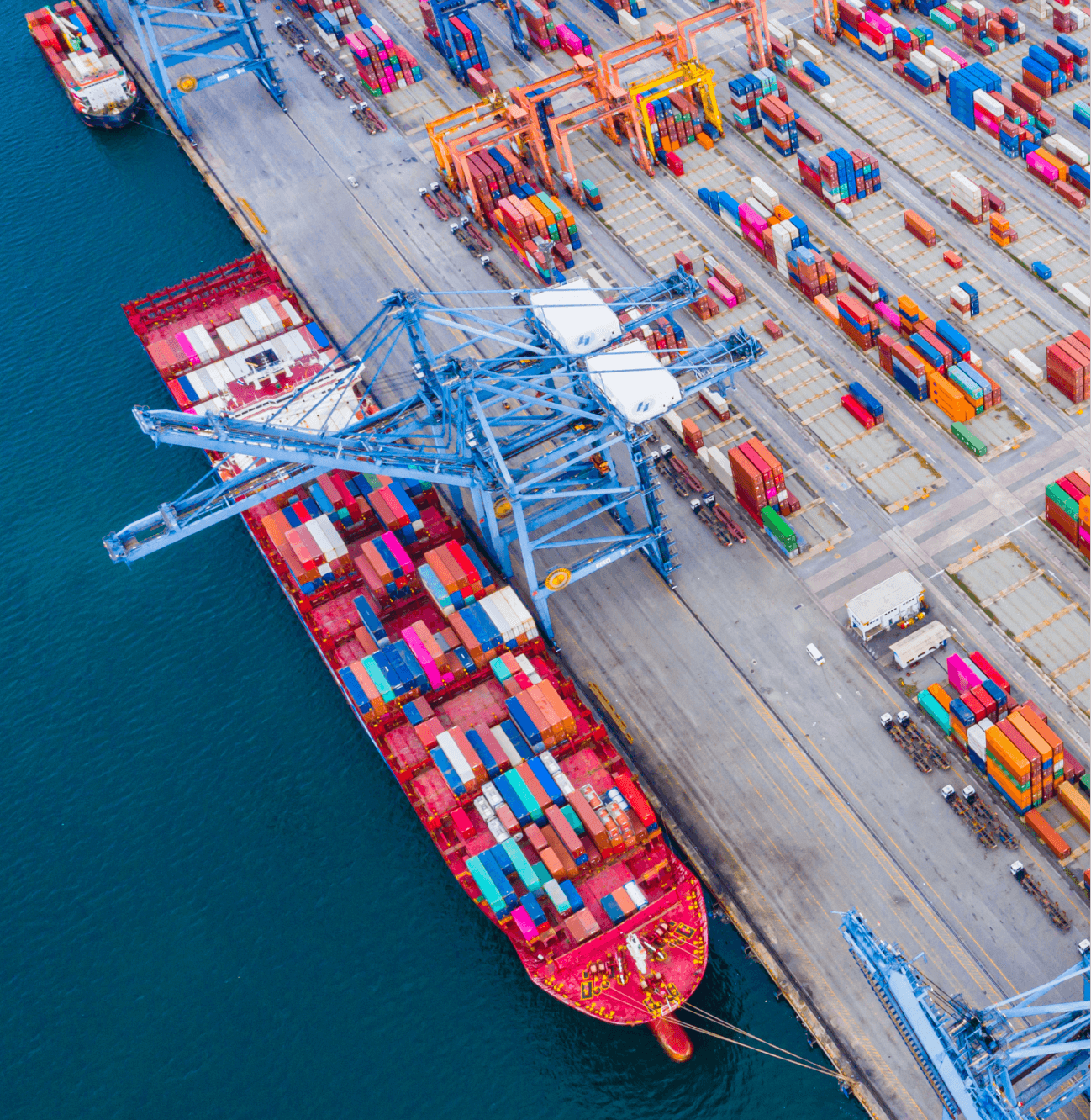

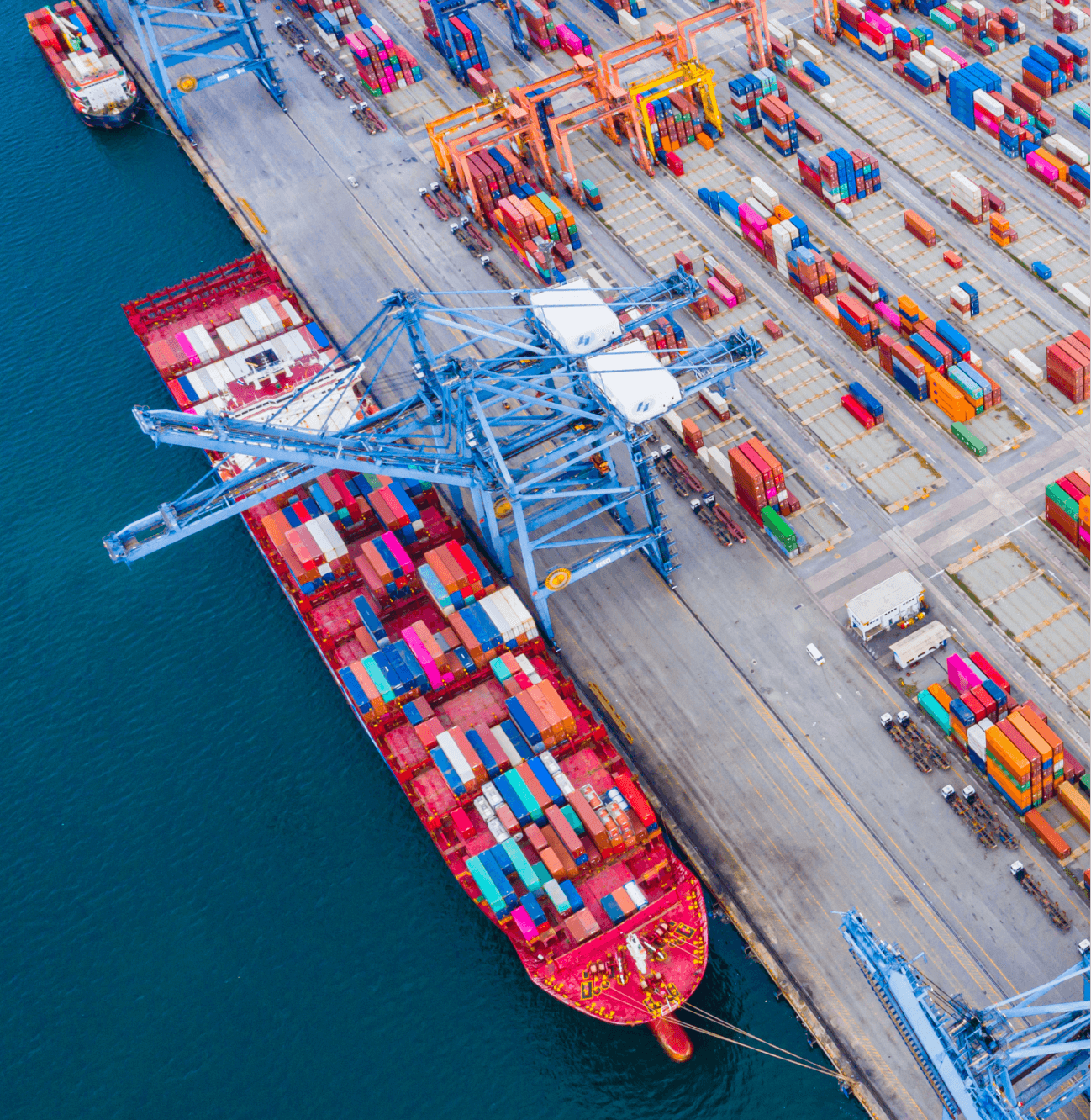

Imagine you are guiding a firm through the vast global trade network. The future of supply chain financing looms ahead, ripe with cutting-edge innovation and tech. As a pro at the digital helm, you see the dual nature of this future: A challenge and a chance.

It calls for a keen grasp of tech like blockchain to change finance transactions and workflows. Digital change in this area is not just about new technology. It is about rethinking global trade, fostering new trade ties, and helping economic growth by tying up with organizations offering supply chain finance programs in the USA.

As you steer into this new realm, seize the promise these leaps hold for your company’s success and the world’s economic ties.

The Evolution of Supply Chain Financing Globally

Picture the epic tale of supply chain financing across the globe, with an old focus on efficiency and cutting costs in trade. Business experts discuss the intense drive to source and move products as cheaply as possible. Yet, recent world events have shifted this to focus on staying strong in tough times.

During the health crisis, SCF became a lifeline for countless firms, helping them weather huge disruptions. Tech leaps have been vital in this change. Take dynamic discounting and online lending sites, for example, which bring value to banks, buyers, and suppliers and make global trade more resilient.

The face of global trade has changed, setting the stage for growth through diversity. Small firms and remote suppliers in emerging nations are now in the global trade game, with economies like Malaysia, Thailand, and Vietnam as early signs of this change in the Indo-Pacific.

Innovation and resilience will continue shaping the future of supply chain financing, leading to a stronger and more linked global economy.

Diversifications Role in Economic Growth and Supply Chain Finance

Diversity lets small firms and remote suppliers, especially from emerging nations, dive deeper into global trade. This inclusivity sparks growth by opening new doors. Nations like Malaysia, Thailand, and Vietnam have seen their economies bloom and diversify, partly due to their role in global supply chains.

Moreover, diversity is key to creating new trade paths and is crucial for evolving global trade. The strategic push towards varied supply chains is clear as firms and nations aim for operational safety. This move is not just about dodging risks; it is about building a solid foundation for ongoing economic growth.

Overcoming Challenges in Supply Chain Finance Diversification

Exploring SCF’s future, it is key to know the hurdles that come with diversity. Diversity brings risks like too much reliance on old production centers, which can curb innovation and limit scaling and making quality goods.

Strategic plans and risk handling are crucial to beat these blocks. It is about being ready, foreseeing issues, and having backup plans.

With these new solutions in mind, let us focus on how they are changing the industry and setting up a dynamic future in supply chain financing.

Innovative Trends Transforming the Future of Supply Chain Financing

The new trends reshaping SCFs future are not just altering the sector. They are making new norms for how firms handle finance. Let us look at some of these big changes:

- Dynamic discounting and online lending sites offer an agile, quick way to finance, helping firms manage cash better and boost supplier ties.

- Fintechs rise in SCF is shaking up old banking ways by using tech for more effective and easy finance options.

- Digital leaps are the force behind these changes, boosting operational ease and offering key insights into supply chain financial health and performance.

Your firm stands to win big from these trends. These techs have the potential to simplify supply chain steps. This change is not just about keeping pace. It is about preparing your business for success in a future where quick action, ease, and smart partnerships are key. The new wave of SCF is here, promising a more linked, resilient, and financially tough global trade setup.

Digital Transformations Impact on Supply Chain Finance Programs

As you tackle global SCF’s complexities, It is key to see how digital change reshapes the scene. Old banks are at a turning point, needing to update their offers to keep up. This change brings both blocks and chances that can redefine SCF’s ease and user experience.

- Old banks need stronger risk controls more than ever, requiring new risk control setups to stop bad practices and protect investor trust.

- Chances from digital change include new options like dynamic discounting, online lending, and new banks that make cash deals more efficient.

- Data study, cloud tech, and automation are key in making SCF steps more agile and intuitive.

As we look ahead, innovation and resilience will continue to shape SCF’s global path. With the right plans and technology, SCF’s future looks bright, offering a more linked, easy, and safe global trade setup. Embracing these digital leaps in SCF is just the start of a path to a more integrated and smart global trade system.

Also Read: Navigating Supply Chain Finance Challenges and Opportunities in Singapore

Steer Your Business Toward a Brighter Financial Horizon

Thinking of the shifts in global SCF, your path through this complex setup highlights the urgent need for new ideas and staying strong. Blockchain and digital platforms, like those from Triterras

As the top name for trade finance services in the USA, Triterras allows firms to tap into better ease, tighter security, and live trade checks.

In a world where quick thinking and smart plans rule, the worth of such leaps can’t be overstated. As global trade winds shift, make sure your business stays ahead. Connect with a Triterras expert to ease your trade now and keep your spot in the changing global market.