- Home

- /

- Supply Chain Finance

Supply Chain Finance Platform for Small and Mid-size Businesses

Unlock working capital and experience cash flow freedom with Triterras’

Supply Chain Finance solution for small and medium-sized businesses.

Triterras’ Supply Chain Financing program

Managing payments and the needs of global suppliers can be challenging.

That is why Triterras is breaking new grounds with its digital solution to help the world’s buyers and suppliers finance receivables more easily and at lower interest rates.

With Triterras’ Supply Chain Finance (SCF) platform, take full advantage of customized, easy-to-use supply chain financing as a way to optimize working capital by speeding up cash flow.

By associating with multiple lending partners, we facilitate access to capital across a broad risk spectrum, ensuring mutual success for corporates, Micro, Small and Medium Enterprise (MSME) vendors and lenders.

how triterras’ supply chain financing benefits your business

Secure your supply chain from disruption with Triterras’ supply chain finance solution. In a time of unprecedented uncertainty, traders gain a competitive advantage by safeguarding the security of stock/ goods or services being exported or imported – whether it be for retail, manufacturing, electronics, automotive or countless other sectors.

Triterras benefits organizations on both ends of the supply chain, enabling buyers to extend their payments and suppliers to get early payment. In short, our supply chain finance solution is a proper win-win solution for both trading partners.

- Buyer Benefits

- Extended invoice payment time

- Off-balance sheet financing

- Efficient asset acquisition

- Flexibility to use the working capital until invoice payment receipt

- Seller Benefits

- Enhanced cash flow

- Reduced credit rates

- Assured availability of working capital funds before the invoice due date

- Improved cash flow forecasting and payment certainty

- Stronger cooperation with buying companies

Explore global trade opportunities with confidence

Take advantage of instant, flexible credit and easy liquidity for your business with Triterras’ supply chain finance solution.

Eligibility Criteria

FOR TRITERRAS' SUPPLY CHAIN FINANCING SOLUTION

Business Experience

3+ years of industry experience.

Track History

Financially solid transaction track record history.

Requirements

For Supply Chain Financing

For us to quickly process your credit application in order to provide you with our supply chain financial services, we will need the following documents:

- Business owner’s ID and proof of address

- Recent VAT and bank statements

- Past three months' invoices

- Vendor-related sales ledger details

- Financial statements for the last three years

- Company’s constitutional documents, such as certificate of incorporation, share certificates, Memorandum Of Articles (MOA), etc

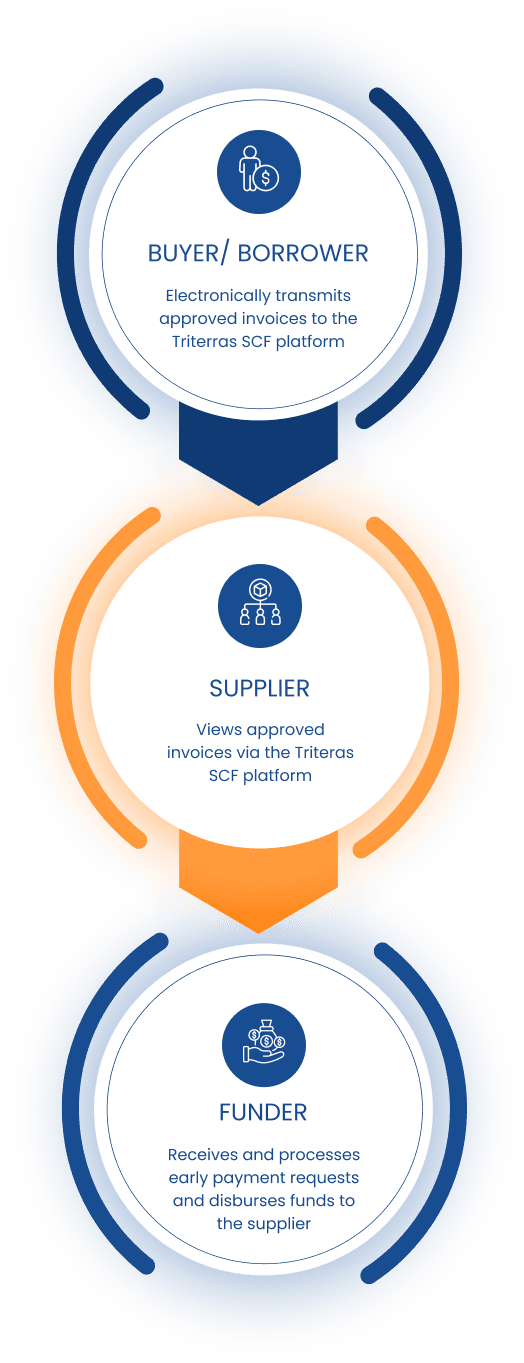

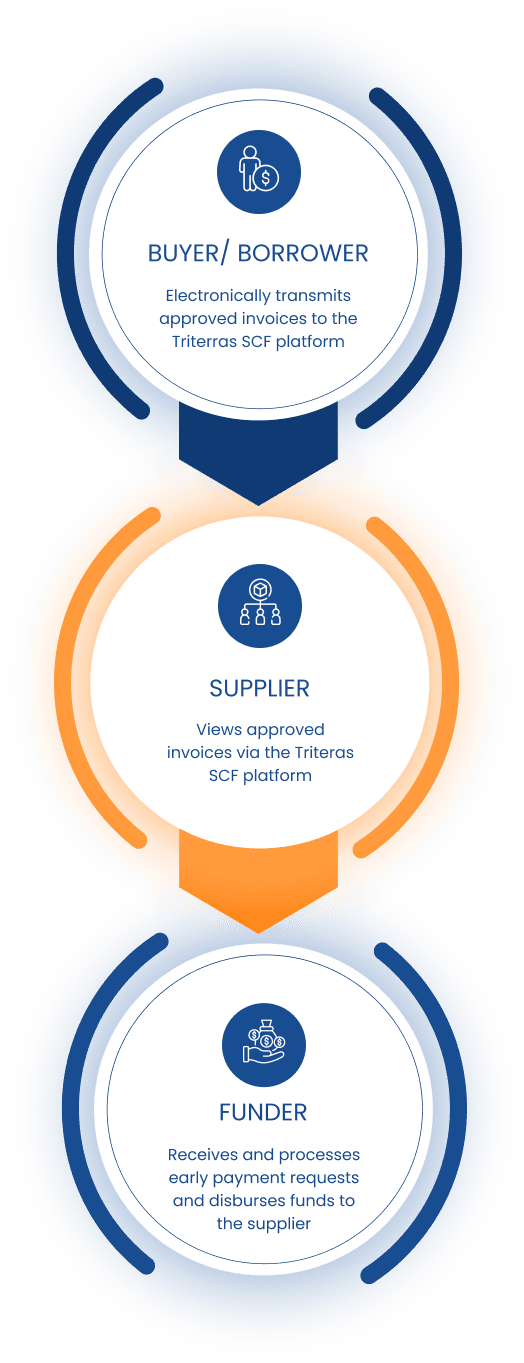

HOW Does IT WORK

Our supply chain finance program is structured to improve working capital position by leveraging stronger credit ratings. The process typically involves the buyer, seller and lender.

UPON SUCCESSFUL CREDIT APPLICATION OF THE BORROWER:

At the invoice's maturity date, the buyer/ borrower settles the loan amount.

Prior to shipment, the Purchase Order (PO) is raised by the buyer and a Performa Invoice (PI) is issued by the supplier.

The buyer instructs the financier to pay the supplier.

The financier makes payment to the supplier based on the PO and related PI.

The goods are released by the supplier to the buyer.

At maturity, the buyer repays the Financier (Principal + Interest).

Fortify your supply chain with Triterras and encourage your business to prosper.

Fortify your supply chain with Triterras and encourage your business to prosper.

Want To Join Our

Esteemed Clientele?

Read What They Have To Say.

Triterras’ collaborative nature encourages staff to exchange ideas freely, sparking creativity leading to ground-breaking solutions that benefit our clients, earning only their trust and loyalty, but also set us up as a prominent leader in the trade finance industry. Working at Triterras has been an immensely rewarding experience, on both professional and personal levels. Colleagues are like friends and mentors, always ready to offer support and guidance. My career with Triterras has been nothing short of extraordinary. I’m immensely grateful for the opportunities and support that I have experienced thus far. I look forward in great anticipation to contribute towards Triterras’ continued success and growth.

It has been nearly 3 years since the end of year 2020 when I applied to establish my career in Triterras as its Customer Success Executive. Since then, I have grown to adore and look forward daily to work closely with some of the brightest, friendliest, and hard-working individuals, where every day also presents new learnings which encourages me to pursue never-ending growth and to pick up new skills, enabling me to do my job in better and in more efficient ways with the new knowledge learnt.

In my challenging and exciting role as a Customer Success Executive at Triterras, I find myself constantly surrounded by extremely talented, yet humble individuals who hail from diverse industries and expertise coming together to learn and contribute in our respective roles, towards the success of the organization. Every day brings great vibes and high energy, as nothing beats having supportive colleagues who are more than willing to share their experiences through mentorship. Being in such an environment makes me feel like I can develop my career, hone my skillset and yet enjoy my time here.

I applied for a career with Triterras because I was seeking a challenging opportunity in my banking operations field of expertise. What’s more, Triterras has policies in place that encourage respect, trust, empathy, and support for one another. I am continuously given opportunities to learn and develop new skills, allowing me a sense of satisfaction and fulfilment in my work area. During the Covid period, though I worked from my hometown instead of the office in Dubai, I was still entitled to all the benefits of new workplace. For aspiring job seekers looking to join Triterras, I am happy to share that Triterras is certainly a place to go to for ample opportunities for professional career growth.

frequently asked questions (faqs)

How will supply chain financing solutions help my business?

Late payments from buyers are the biggest impediment that can cause a cash crunch that can lead to slow or nil growth. However, with supply chain financing, organizations can ensure cash flow continuity even when other short-term credit options are unavailable.

How will you evaluate the credit score for my business?

Like most banks and financial institutions, we will conduct your credit evaluation based on your most recent bank statement, and VAT return statements.

What is the turnaround time for credit evaluations?

With the correct documentation, the process takes no more than 15 days.

What is the cost of investing in your supply chain finance program?

Supply chain finance is affordable because buyers need not incur extra expenses to extend the payment period. The supplier pays a discounted rate to clear their outstanding payment before the deadline.

On what basis is the interest rate calculated?

The interest rate is calculated based on the daily usage of the credit limit.