Fintech for Trade Finance

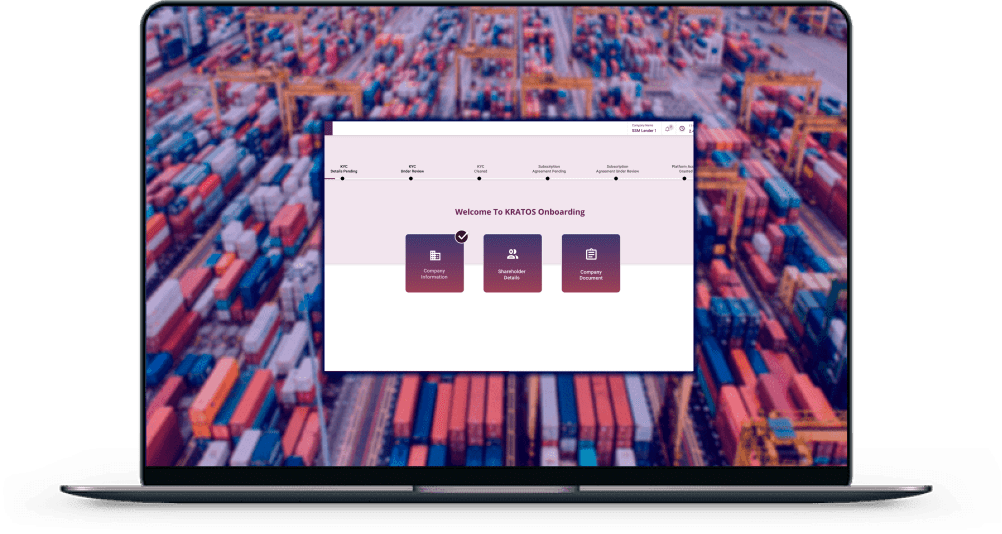

An end-to-end, blockchain-enabled Trade Finance Solution

Join Kratos, one of the world’s largest blockchain-based trade finance platforms and digitize your trade and trade finance processes.

ADDRESSING THE GAP WITH KRATOS™

KRATOS™ trade finance platform

Bridging The $2.5 Trillion Trade Finance Gap

Micro, small and medium sized businesses (MSMEs) form the backbone of our global economy. However, when it comes to trade finance, most of the MSMEs are underserved with more than half of their funding requests often being rejected by banks.

In fact, many traders cite the lack of adequate trade finance as the primary constraint to their growth and success. But not any longer.

Introducing our Kratos Platform – a next-generation blockchain-based digital trade finance platform enables Triterras to take the lead as the first-of-its-kind mover that is bridging the $2.5 trillion gap.

With Kratos, Triterras actively supports under-resourced small businesses through its collaboration with alternative lending partners.

KRATOS™ platform

transforming trade finance

Kratos bolsters supply chain strategy with real-time tracking, digitized transactions, streamlined credit management, and greater business intelligence to enable complete traceability and transparency. Our blockchain trade finance platform reduces the complexity of cross-border trade financing and provides increased flexibility to banks and corporates.

Experience the transformative power of digital supply chain finance solutions. Modernize every touchpoint of your supply chain with Triterras.

KRATOS™ core platform

platform features

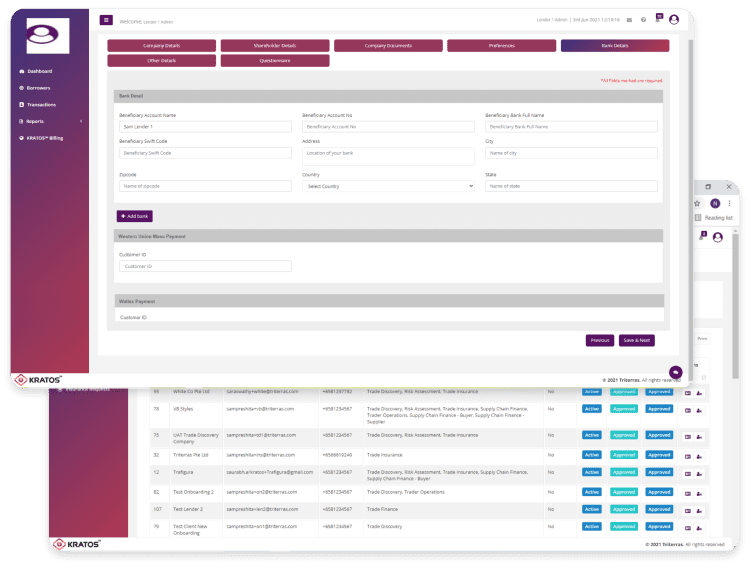

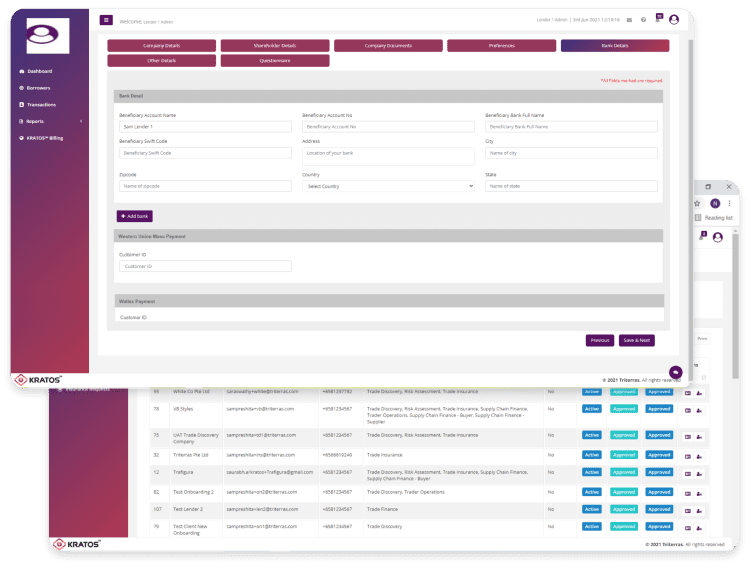

Securely share sensitive documents between companies and synchronize with other systems when using the Kratos trade finance platform.

The user-friendly interface makes it easy to operate.

-

INDUSTRY-GRADE AML / KYC

Know-Your-Customer (KYC)/Anti-Money Laundering (AML) background checks help validate client information and ensure compliance and security. -

DIGITAL AGREEMENTS

Blockchain technology stores digitized trade documents to reduce the risk of document tampering and ensure transparency. -

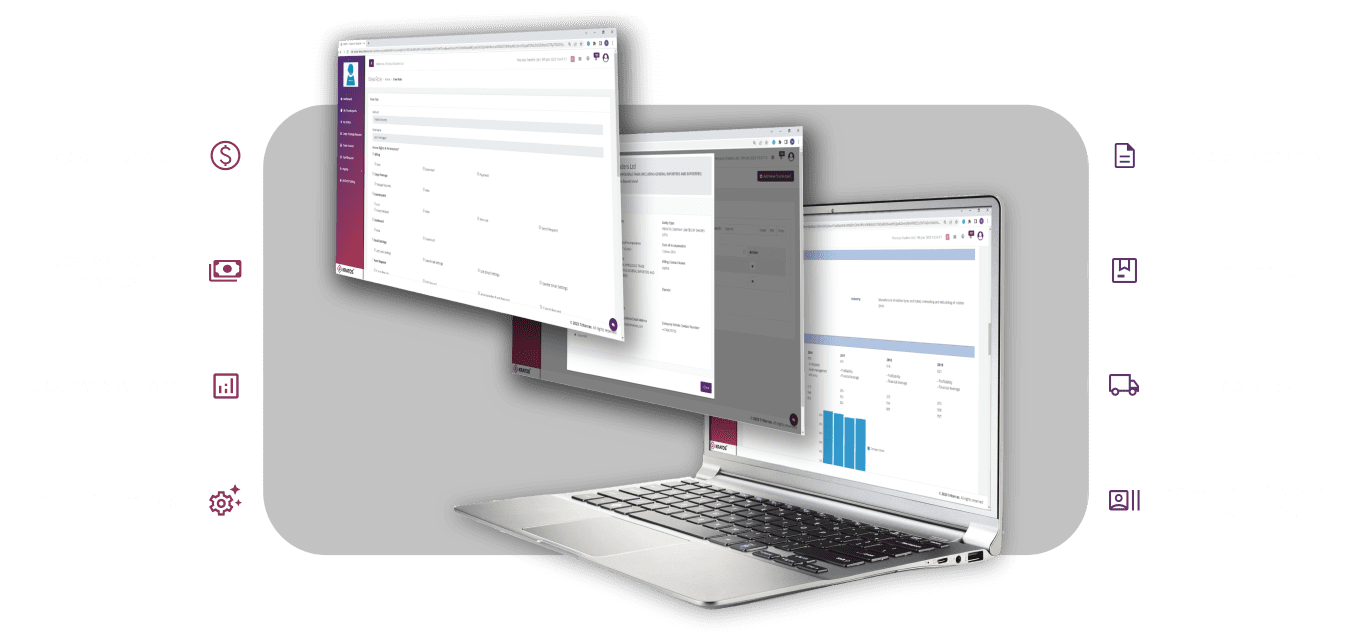

DASHBOARDS

Data visualization using customized dashboards provide insightful analysis and guide strategic decisions. -

PERMISSIONS CONTROL

User and role-based permissions are assigned to individuals to define what actions are permissible to perform. -

NOTIFICATION SYSTEM

Platform-based messages and email notifications are sent to users to keep them updated on their transactions. -

CHAT FEATURES

Users can communicate directly with counterparts and lenders in their network, and access to chat history is provided for assistance and easy reference. -

DIGITAL AUTHENTICATION

Automatically authenticated signatures are enabled by the platform to ensure maximum security and authenticity. -

CENTRALIZED AND STRUCTURED INFORMATION

Messages are sorted into smart folders according to user rules, and a centralized view shows the entire message history at a glance. -

DATA TRANSPARENCY AND TRACEABILITY

Electronic storing of substantiating documentation of trade operations in distributed ledgers enables the sharing of unprecedented, non-falsifiable information on a global scale.

trade finance solutions for buyers, suppliers, insurers & lenders

-

Trade Discovery

Provides a secure platform for buyers and sellers to conduct bilateral transactions with various counterparties and enables seamless procurement and sales of goods. -

Risk Management

Allows traders to check AML or KYC and the company's credit rating of their counterparties. Conducts comprehensive checks on bills of lading. -

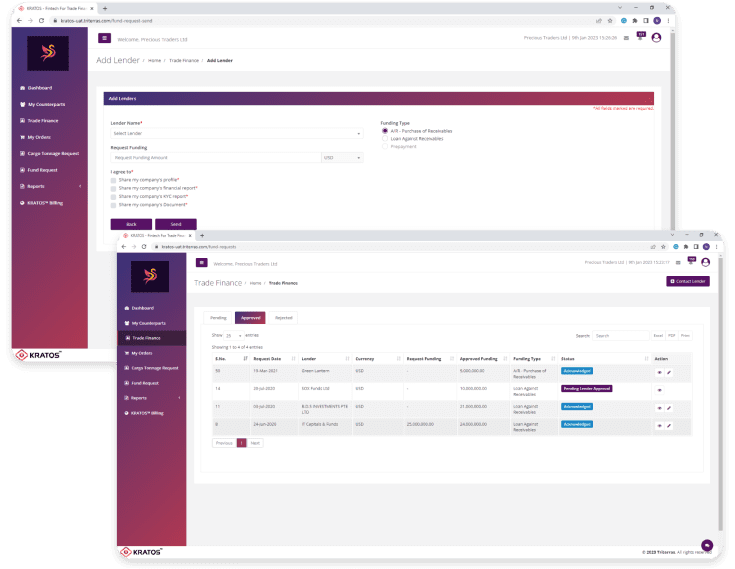

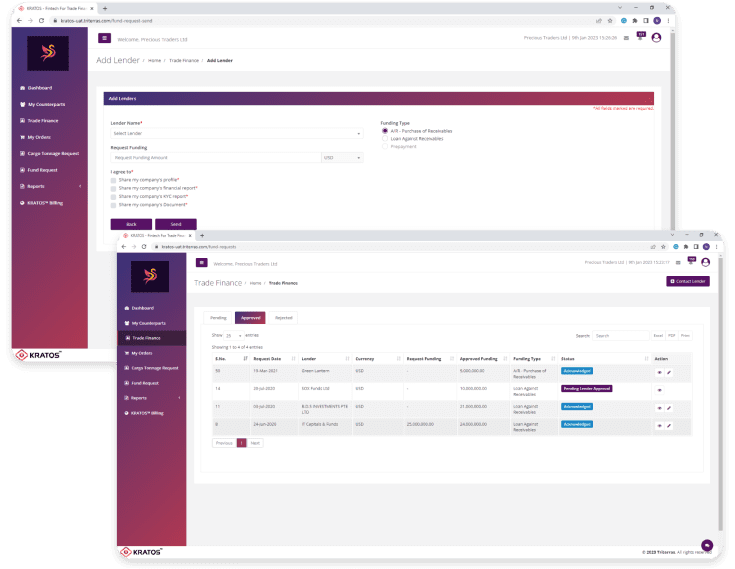

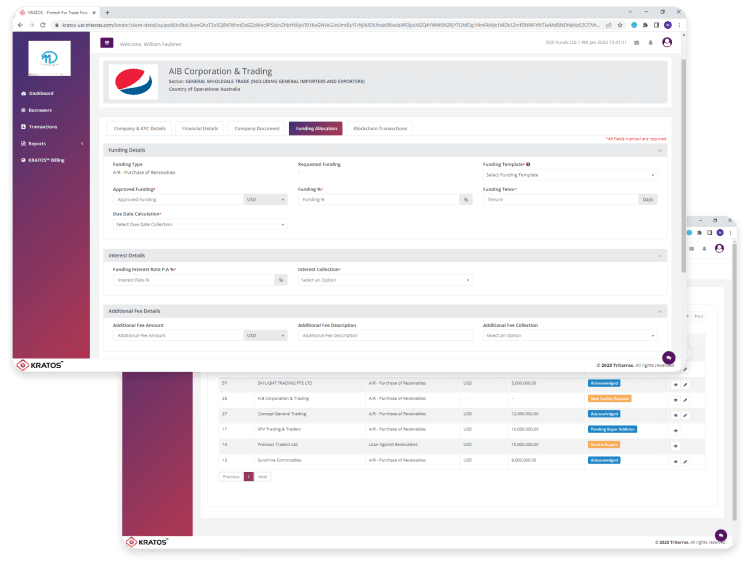

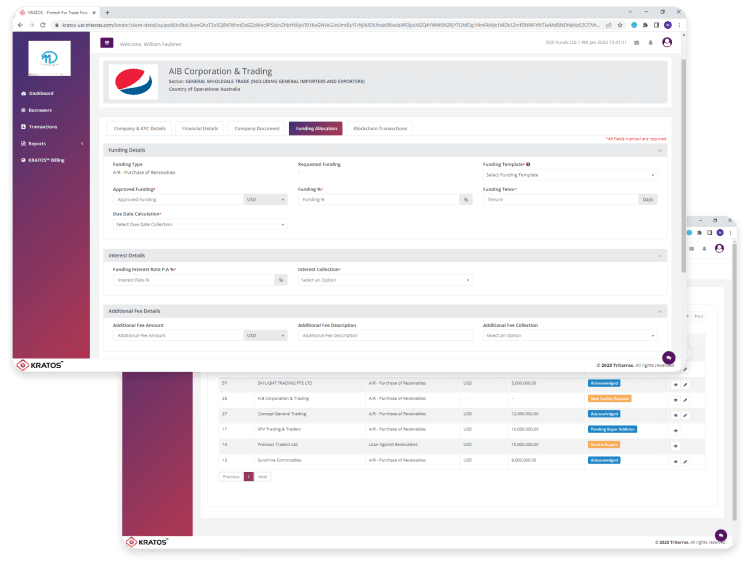

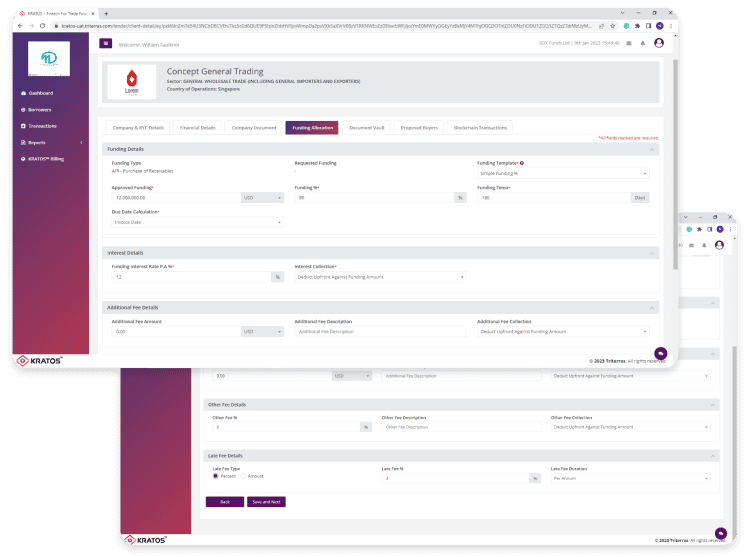

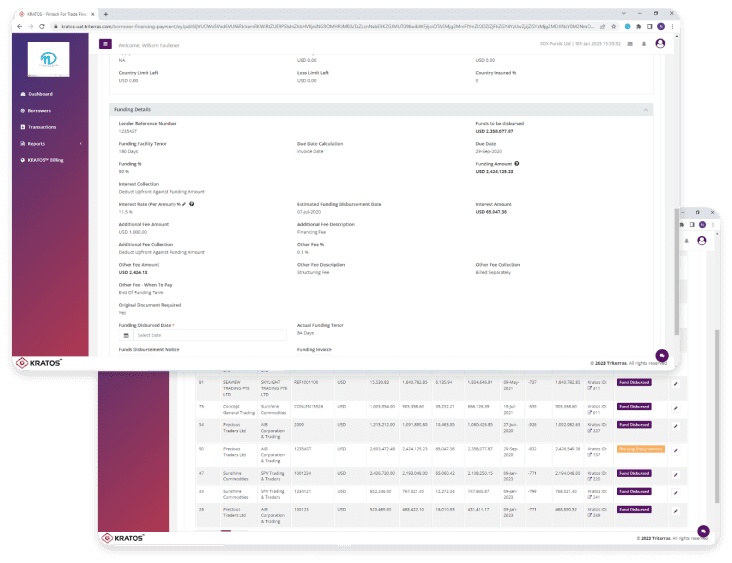

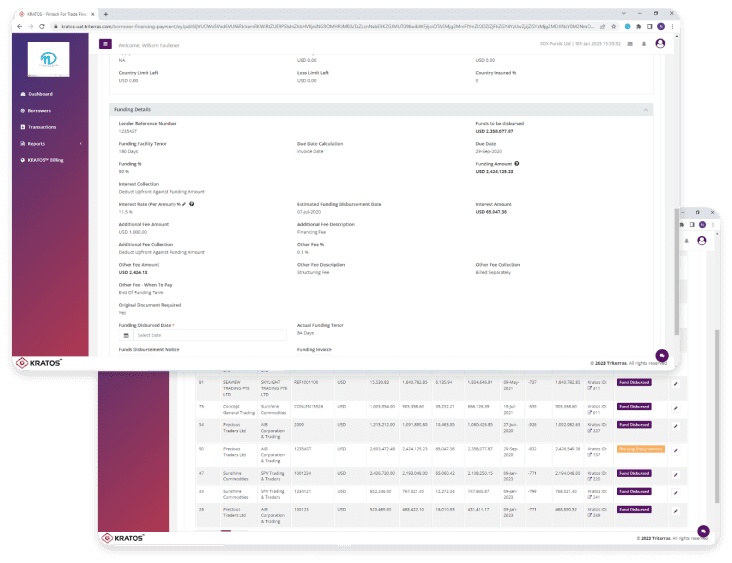

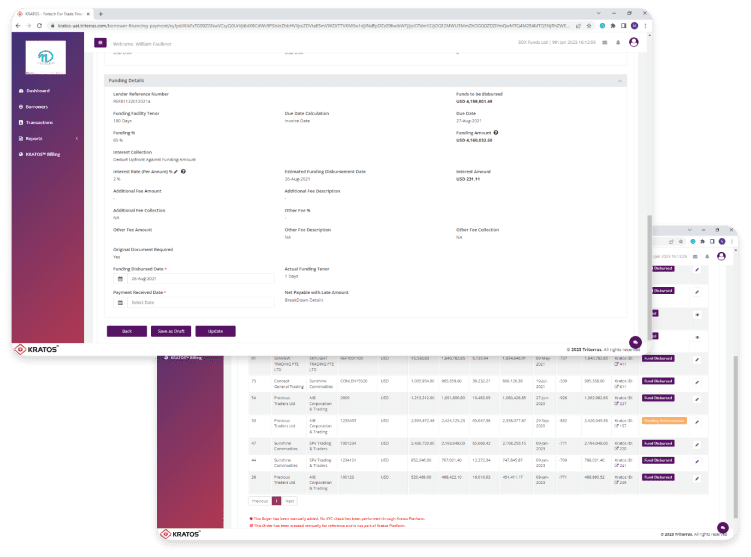

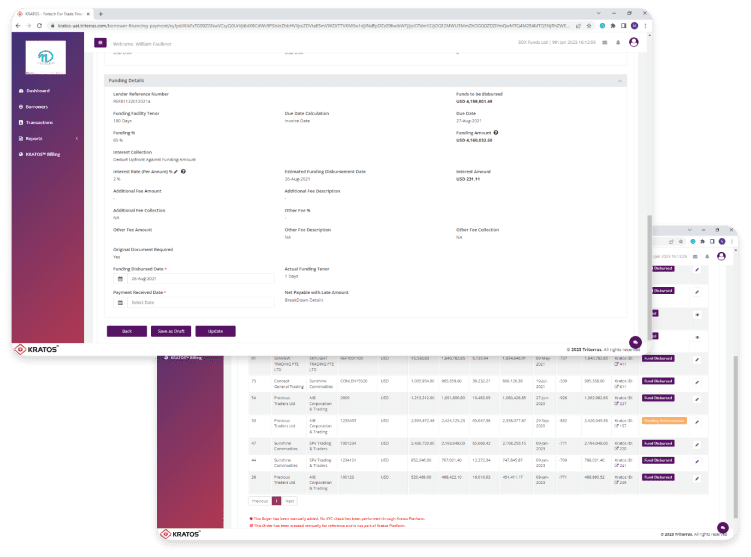

Trade Finance

Provides platform-based lenders easy access to borrowers for funding their trades. Lenders can track and manage their investments using a customizable dashboard. -

Supply Chain Finance

Collateralizes outstanding invoices to provide suppliers with additional operating cash and to extend the buyer's or manufacturer's Days Payable outstanding (DPO). -

Insurance

Offers a platform for traders and lenders to request credit insurance from available insurers. -

Logistics

Facilitates management of functional aspects like post-fixture, chartering, voyage financials, etc., for freight operators, ship owners, and charterers.

KRATOS™ platform functional features

Kratos utilizes advanced technology, enabling traders to expand and become more profitable.

-

Increased Validations

Minimizes operational risks through regular checks. -

Automated Portfolio Management

Drives profitability and visibility. -

Reduced Transaction Times

Quicker processing of drawdowns and credit facilities. -

Increased Flexibility

Customizations and integrations with third-party systems. -

Complete Transparency

Cloud-based results in zero downtime, leading to higher efficiency. -

Intuitive Design

Easy-to-use platform with user-friendly interface.

Unleash the potential of the Kratos platform to steer your business on the growth trajectory.

Join Kratos now!

come onboard KRATOS™ today

The KRATOS™ trade finance platform benefits

The Kratos blockchain-enabled trade finance solution ensures the legal and technical security of the digital originals, providing a one-of-a-kind and all-in-one solution.

-

Exporter/Importer

- Simplified documentation and cross-checking

- Bill of lading (B/L) crisis prevention

- Tracking of shipment statuses in real-time

-

Logistics

- Better data accuracy and streamlined B/L and Seaway Billing

- Enhanced logistical status visualization creates new added value

- Immediate response to evolving trade compliance rules

-

Banks

- Simple and accurate letter of credit (L/C) issuance

- Quicker trade transactions with reduced overhead costs

- Leverage new financial services using Kratos

-

Insurers

- Streamlined documentation, operations, and increased data accuracy

- Reduced risk of theft, document tampering, and document loss

- Reduced lead time and mailing costs

- Reduced risk of double payments

-

Customs/ Regulators

- Increased transparency of document originality and authenticity with digitization

- Upgrade the screening process with relevant application information

Unify every moving part of your supply chain in one secure, reliable and agile platform.

Prepare yourself for the future of digital trade.

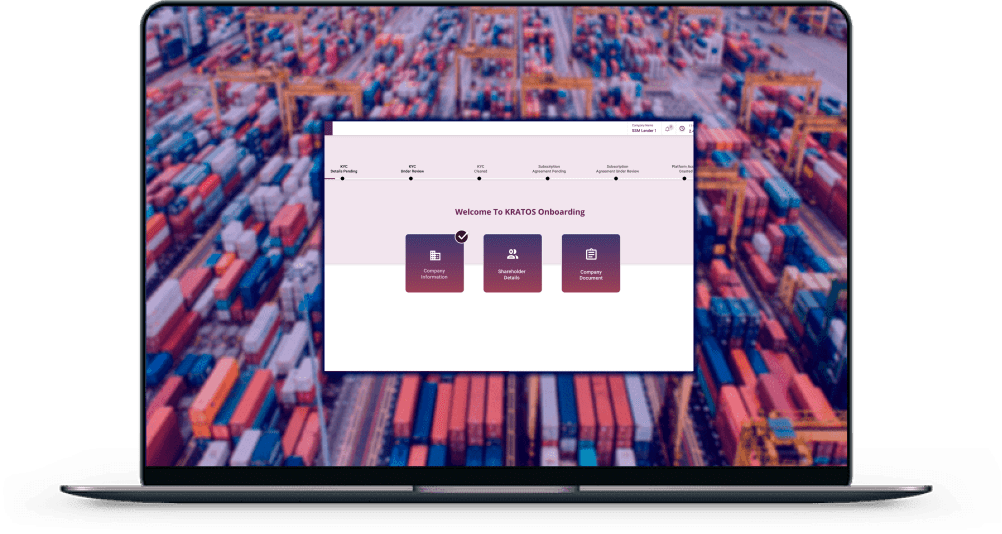

how does it work

This is how KRATOS™ works.

-

Complete KYC

Complete KYC -

Financing Options

Financing Options -

Approve Facility

Approve Facility -

Financed Transactions

Financed Transactions -

Lender Approval

Lender Approval -

Borrower Repayment

Borrower Repayment

-

Kratos completes the “Know Your Customer” process for all relevant parties.

Kratos completes the “Know Your Customer” process for all relevant parties.Step 1 : Complete KYC

-

Borrower selects the funding option and requests facility from the lender.

Borrower selects the funding option and requests facility from the lender.Step 2 : Financing Options

-

The lender approves the facility after performing due diligence.

The lender approves the facility after performing due diligence.Step 3 : Approve Facility

-

The borrower requests the lender for transactions to be financed.

The borrower requests the lender for transactions to be financed.Step 4 : Financed Transactions

-

Funds are disbursed after the lender approves the borrower’s requests.

Funds are disbursed after the lender approves the borrower’s requests.Step 5 : Lender Approval

-

The borrower repays the money to the lender on or before the maturity date.

The borrower repays the money to the lender on or before the maturity date.Step 6 : Borrower Repayment

frequently asked questions (faqs)

I want to be a part of the Kratos Platform. What is the procedure?

To sign up on the Kratos Platform, please submit your details here or click on the “Request Demo” button at the top of the page.

Where does Kratos source the funding from?

We source our funding from alternative lenders and private equity managers with whom Triterras has a longstanding relationship.

May I request a demo if I am from an incorporated company?

Yes, you may. We will require your company name, address, and email for signing up.

Can you tell me more about the blockchain technology that underpins the platform?

The Kratos web application was developed using Ethereum’s decentralized technology. Midway through 2021, we transitioned our Kratos platform to a Hyperledger private blockchain managed by Amazon Web Services (AWS).

AWS infrastructure provides Kratos with robust security tools and protections, specifically mitigating potential security risks.