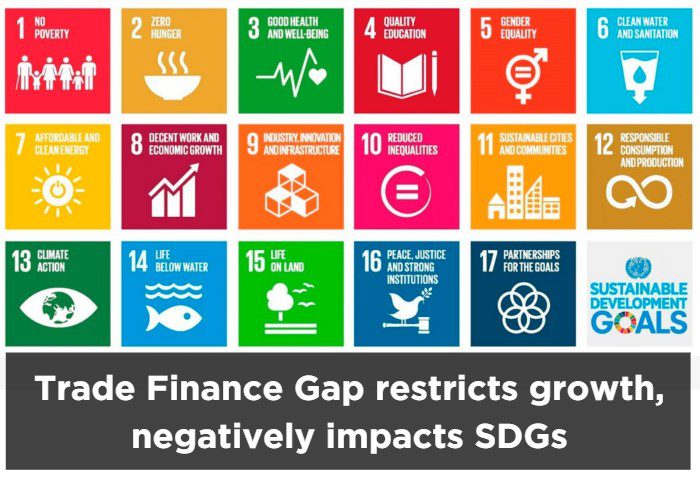

Lately, banks in Pakistan have become reluctant to give loans to the private sector, especially to SMEs, for four main reasons. First and foremost, banks find it very difficult to recover bad loans due to the inability to enforce contracts because of flaws in the judicial system. Secondly, many Pakistani SMEs maintain two sets of financial books. In the official ones, they understate profits and inflate expenses to reduce tax liability, making it challenging to assess credit risks and repayment capacity. Furthermore, banks in the country are risk-averse. Lastly, government borrowings from banks have leapfrogged, leaving banks with less money to lend to the private sector.

FinTech’s Green Revolution: Nurturing Sustainable Practices Among Small Businesses

BY Triterras

- 09/04/24

Ashish Srivastava, our Triterras' Chief Commercial Officer shares in-depth with Intelligent Fin.Tech, a global technology intelligence platform which gathers the latest financial information, on how FinTech has emerged as a crucial catalyst, motivating and supporting small to medium enterprises on their path towards environmental responsibility through sustainable trade finance.