Supply chain finance has outpaced the traditional trade finance market. This trend is expected to continue to accelerate due to the market’s increased focus on working capital and the step-change in digital adoption. At a time when there is a risk of traditional bank revenue stagnation, both banks and non-banks should consider what it would take to carry out a cost-efficient infrastructure for supply chain finance at scale.

Banks, alone, have traditionally had less influence over the progress in supply chain finance. Leading global banks have lacked scalability for serving small medium enterprise and mid-market company sectors, which often have a higher margin but lower transaction size per ticket. Many of these institutions are also in need of suitable processing infrastructure.

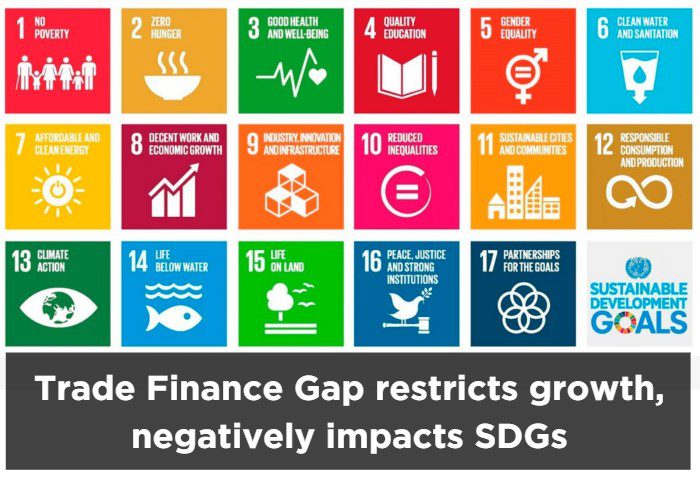

The $1.7 trillion global trade financing gap can be attributed to this undersupply of a fully digital, seamless experience in larger banks. Emerging fintechs, and their ability to process information through digitalization and automations, are widening access to supply chain finance. AI-enabled financing has resulted in a dramatic reduction in end-to-end operational costs from origination to funding and ongoing transaction servicing.

Teamwork makes the dream work

With the acceleration in the digital age, regional banks and fintechs working together can make for quite the partnership, especially for supply chain finance. A new report from Cornerstone Advisors found nearly 9 in 10 financial institutions consider fintech partnerships to be important. For banks that have invested in fintechs, the average investment has increased over the past three years.

65% of banks and credit unions are engaged in joint partnerships with fintech companies today, and fintech partnership activity among regional banks is expected to rise as more institutions are gaining confidence that tech partners can help their companies increase revenue. Overall, the industry is positively demonstrating fintech partnerships aren’t posing a threat to the finance industry; they’re simply forming an alliance to increase loan volume and productivity.

As it relates to supply chain finance, one route for regional banks to help close the financing gap is to join a fintech hosted platform. By joining a platform as a funder, financial institutions can focus on their core offerings of underwriting and funding rather than trying to figure out how to build or buy. Platform partnership lowers customer acquisition cost and significantly shortens the origination to execution timeline, all while saving on substantial development and maintenance costs.

Bringing all market participants onto the same connected ecosystem only serves to increase revenue for both lenders and traders. Another positive result from these services shows the relationship between the depository institutions and their digital comrades have led to lower delinquency rates, or late payments.

Our go-to guys

Having identified the serious imbalance between demand and supply, Triterras has paved the way for institutional lenders to get more involved at scale. Triterras operates Kratos, the world’s largest blockchain enabled supply chain finance platform designed with a smart tech stack built to improve both access and reliability in global trade.

At Triterras, we understand how crucial better risk management is to all parties involved, that is why we have designed our platform to include transparent and traceable operational efficiencies. Core to our mission is to enable an ecosystem that thrives on collaboration and partnership. Gone are the days of siloed competition.