Triterras understands that living on a shared planet with finite resources means that managing our environmental footprint responsibly, empowering our people and operating ethically are non-negotiable. Our approach to ESG is multifaceted, and after much assessment and level-setting, we’ve established an ESG framework, comprising initiatives, authentic to the Company’s mission and values. We’ve started from the premise that our facilitation of capital to micro, small and medium enterprises (“MSMEs”), a traditionally underbanked segment which is the economic growth engine of emerging economies, better communities, lives and livelihoods of customers transacting on our digital platform (as opposed to archaic and paper-based systems and processes plaguing trade finance). Moreover, environmental benefits, such as reduced carbon emissions, are associated with moving from paper-based to digital trade transactions.

We are working to optimize sustainability products for customers and investors to respond to their compelling need for practical solutions that drive positive tangible change to the gamut of ESG issues we face today, especially climate change-related. Some of the initiatives in place or we are working on:

- Building ESG-centric products & functionalities to Kratos to measure and report on customers’ sustainability risk profile and offer them to self-report on their ESG activities.

- Promoting a paperless environment, both in our offices and digitally, on Kratos. We estimate that to date, approximately a total of 315,936.0 pages are saved, resulting in emissions offset of approximately 17,692,416.0 (gCO2e), based on the number of digital transactions conducted on Kratos as of February 2022.

- Transitioning to energy-efficient equipment

- Introducing sustainability into the procurement process

- Beautifying our workspace while improving air quality with indoor plants

- Encouraging our employees to reuse and recycling

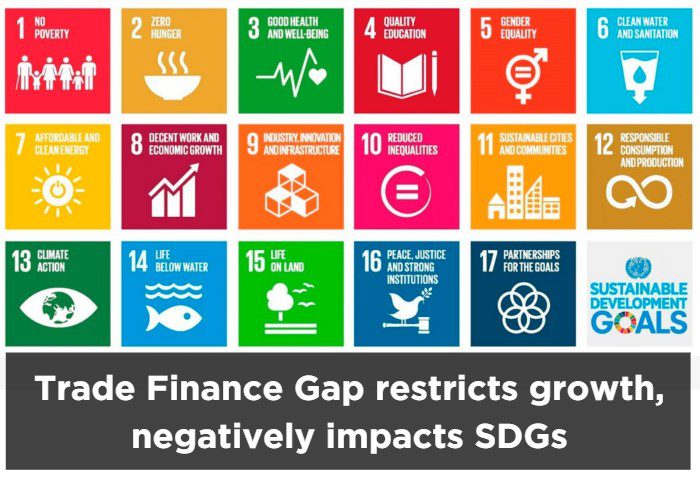

In May 2022, we retained Diginex, a leading sustainability firm, to advise on our ESG implementation, integration and reporting. The nature of the ESG initiatives mentioned herein and set forth in our framework are linked to the applicable standards of the United Nations Sustainable Development Goals (UN SDG) 2030, Sustainability Accounting Standards Board (SASB) standards and The Task Force on Climate-Related Financial Disclosures (TCFD).

We strive to empower employees by creating an inclusive and diverse work environment that encourages the best of human interaction, supporting their growth, development, health, and wellbeing. We are proud to share that currently, 52% of our employees are female, and we will continue to improve upon that achievement, always striving to attract, develop and retain a strong and diverse workforce and Board that reflect the communities we serve in Singapore, Dubai, and the U.S.

Earning the trust of our shareholders, employees, customers, partners, and regulators is key to our success. Our ongoing commitment to multi-dimensional governance that serve the best interests of the company, and its stakeholders is uncompromising. We strive to implement best practices, transparency, and accountability backed by continuous enhancement and assessment. We will continue to steadily implement tools, processes, and procedures, with the support of external advisors as needed, to elevate our governance infrastructure and embed the appropriate controls for continuous assessment.

There is no single pathway or destination on our journey to drive change through responsible and sustainable operations and value chain. We are committed to and excited about each step along the way, that is authentic to us and brings value to our employees, our customers, shareholders and other stakeholders.